Automatic Payments For Small Business

Bringing Payment Automation To Small Business

Despite the multitude of communication tools on the market, for many of us, reaching someone in an organization is proving to be increasingly more difficult. That’s particularly a problem if you’re a business owner trying to get an open invoice paid. No one answers their phone and getting a call back from a voicemail is proving to be a skill in and of itself.

If you’re like many of the small businesses in America, this scenario is an unfortunate part of your daily routine.

Fortunately, there is a solution . . .

Payment Automation!

Let’s dig in. You’ll see how quickly you can create some consistency in your cash flow and free up some of the time you and your staff spend chasing down your customers.

Objective

Electronic Payment Processing is designed to make your company more efficient by reducing labor-intensive processing. Incremental conversions to automated payments can result in exponential gains in office productivity in a relatively short period of time.

Benefits

• Increased Efficiency

• Increased Profitability

• Reduced Bank Fees

• Reduced Payment Processing Fees

• Improved Accounts Receivable Processing

• Improved Collection

• Automated Accounting Processes

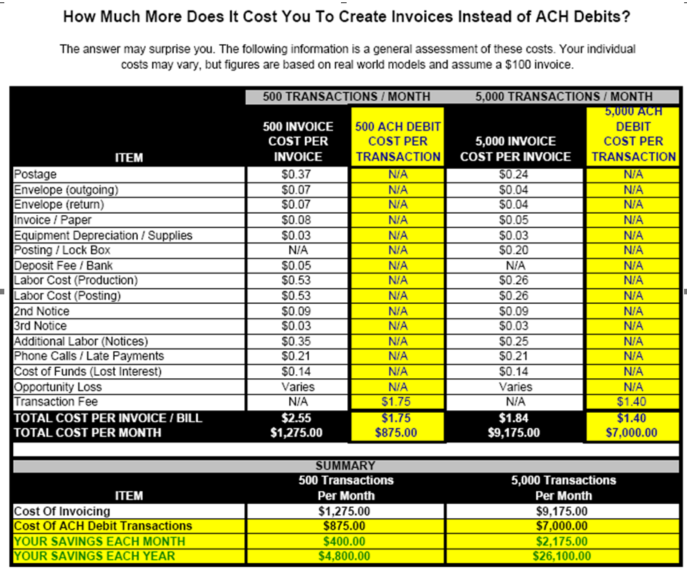

Processing Cost Comparison of Processing a $100 Sale

Recurring Monthly Payment

American Express (non-swiped): $3.50 (3.50%)

Visa or MasterCard (non-swiped): $2.85 (2.85%)

ACH Debit (Check): $0.55 (0.55%)

Payment by Phone

American Express (non-swiped): $3.50 (3.50%)

Visa or MasterCard (non-swiped): $2.85 (2.85%)

ACH Debit (Check): $0.55 (0.55%)

Payment via Your Website

American Express (non-swiped): $3.50 (3.50%)

Visa or MasterCard (non-swiped): $2.85 (2.85%)

ACH Debit (Check): $0.55 (0.55%)

The True Cost Of Invoicing

ACH Recurring Debit processing is a fraction of the cost of processing credit card transactions. The conversion to an ACH Automated Payment Program is one that will reap long-lasting benefits to your business. Not only will you reduce transaction processing costs dramatically, but you will also see a reduction of labor, bookkeeping and other expenses related to payment processing.

The process (and it is a committed process) is one that must be worked on by your staff in their daily interaction with your tenants. An ACH Automated Payment Processing Program is easily and inexpensively implemented. In fact, we can help you see enrollment results immediately!

ACH Debit Overview

Auto-Debit allows you to focus on the important parts of your day and relieves the worry of

collecting your money. Automatic Debits can become an integral part of your organization.

With ACH processing, the payment collection process is reduced to an ACH debit, and an off-setting entry to the accounts receivable system.

Your customer signs your “Auto-Debit Authorization” form.

You create and transmit the payment file to us, electronically. (can be automated)

Available funds post to your settlement account within 1-2 banking days.

Electronic Return Files are sent daily, allowing automatic A/R updating

Advantages of ACH Debits

Substantial savings when compared with Credit Card processing

Improved your cash flow and cash forecasting

o You know the exact dollar amount and precise day that available funds will be deposited into your Settlement account.

o Compare this to the paper system, where the bank can return checks for up to 14 days.

Handling Return Items

Electronic Re-Presentment of Returns

Online, Daily Status Reporting

Turn NSF’s into A Profit Center with Allowable Return Fee Expense Billing Additions

Electronic Account Monitoring Translates to Improve Re-Presentment Collection Success

Up to 2 Re-Presentments Allowed

Summary

We’ll make sure your conversion to an electronic payment system is smooth and its implementation fast and worry-free.

We will train your staff in using our Online Virtual Terminal

We will assist you in implementing the ACH Automated Debit Program

We will provide customer service support to your staff during business hours

We will make sure the funds received are electronically deposited to the proper account

Getting Paid Automatically should be part of your receivables collection plan.

For a free consultation, where we’ll run the numbers on your business to show you the savings and demo our state of the art platform, contact us here

or CALL 877-743-1551